By Xi Chen, Decision Resources Group

An aging baby boomer generation and rising obesity rates have driven steady growth of the U.S. patient population. At the same time, increased use of endoscopy in the evaluation of many pathologies, as well as demand for less invasive treatments, will continue to propel the use of endoscopes. Consequently, there will be a growing need for a highly efficient endoscope servicing industry to help facilities maintain their endoscopes and keep up with expanding procedure volumes. Endocavity Ultrasound

However, falling prices will hinder the endoscope service market. The Affordable Care Act (ACA) has introduced seemingly contradictory goals of delivering quality health care while simultaneously lowering costs. This stated policy has driven a major wave of hospital mergers and partnerships in the last two years. These mergers also include "vertical acquisitions," in which hospitals combine with outpatient clinics and private physician practices. This has led to a shift in the supplier-buyer dynamic, with group purchasing organizations (GPOs) and hospital financial organizations having a greater influence over purchasing decisions. These larger hospital conglomerates have more leverage to negotiate discounts from endoscope service providers, which has limited the provider's ability to raise prices to keep up with inflation and rising operating costs.

In addition, many third-party service providers have sprung up in the U.S. over the last 20 years to claim a share of the largest endoscope service market in the world. These companies have thrived under the demand from hospitals for more affordable services, as well as services for older endoscopes — which original equipment manufacturers (OEMs) often do not repair. Many third-party companies have proven themselves to offer reputable and high-quality endoscope repairs with turnaround times that are sometimes faster than those of OEMs. Consequently, these companies have grown over the years to hold a significant portion of the U.S. endoscope service business. At present, they service almost one-third of all endoscopes and generate about 20 percent of the revenues in this space, exerting tremendous competitive pressure on OEMs.

The Competition Between OEMs and Third-Party Service Providers

Healthcare reform and cost containment pressures have led to interesting dynamics between OEM and third-party competitors. While the upfront pricing advantages offered by third-party companies are becoming more attractive in an era of budget cuts, OEMs have increased their marketing efforts to highlight the benefits of OEM endoscope servicing, which include:

In response, third-party companies have brought forth a number of unique advantages, in addition to a lower upfront price tag:

Where Does The Opportunity Lie?

Historically, third-party companies have a strong position in ambulatory service centers (ASCs) simply because most ASCs are for-profit motivated, particularly ones with physician ownership. Public hospitals have seen a more even split between OEM and third-party services, with third-parties primarily servicing older endoscopes that have come off contract with OEMs. For-profit hospitals tend to be more aggressive in banding together to form single owner conglomerates, which gives them leverage to negotiate more favorable deals with OEMs than most not-for-profit entities.

OEMs also have traditionally staked their claim to university hospitals and academic medical centers by investing heavily in the training of young surgeons to inculcate a preference for their products and services from a very early stage of the doctor’s career. In general, health care facilities that are less concerned about money have mostly stuck to OEM services because of the general perception that their repairs are of higher quality.

The Post-ACA Market Is Transforming The Third-Party Industry

Following the post-ACA hospital merger mania, some hospital conglomerates — particularly those owned by universities — have begun to take their newly acquired subsidiaries off third-party contracts, as they can negotiate better deals with OEMs. As a result, the third-party endoscope service industry has undergone considerable transformation in recent years.

Smaller, regional players are falling off the radar and many are banding together into larger national service networks. For example, health care service provider STERIS entered the endoscope repair business through its acquisition of Spectrum Surgical Instrument and Total Repair Express (TRE) in 2012. Since then, other third-party companies have been incorporated under the larger STERIS umbrella. These include Florida Surgical Repair, St. Louis Life Systems, and Alabama-based Integrated Medical Systems (IMS). Acquisition by larger health care entities like STERIS provides these third-party companies with substantial financial backing, advertising opportunities, and access to existing customer relationships nationwide.

The consolidation of these regional players also provides them with the necessary geographical coverage to effectively compete against OEMs for GPO contracts. In addition, the existing sterile processing business of STERIS complements endoscope repair, and can help to increase the company’s perceived credibility. These services also can be offered as a bundle, which can be particularly attractive to hospitals seeking to lower their operational expenses. Therefore, it is highly likely that the demand for third-parties will grow again if hospital profit margins continue to shrink going forward.

The threat from third-party companies is real. OEMs need to evolve with the market in order to retain as much of their business as possible. Strategies can include:

There exist both opportunities and challenges in the U.S. market for endoscope service. On one hand, the increased use of endoscopes for disease diagnosis, as well as the growing demand for minimally invasive treatments, will continue to buoy the market. On the other hand, ongoing budget cuts and cost constraints of the post-ACA market have limited profit margins. As the third-party service industry continues to transform in response to new market challenges, it is imperative for OEMs to evolve in order to stay on top of the game.

Xi Chen is an analyst at Decision Resources Group. He has authored reports on laparoscopic, ENT, and sports medicine devices in the endoscopy division of the company. Xi Chen holds a doctoral degree in biomedical engineering from the University of Toronto.

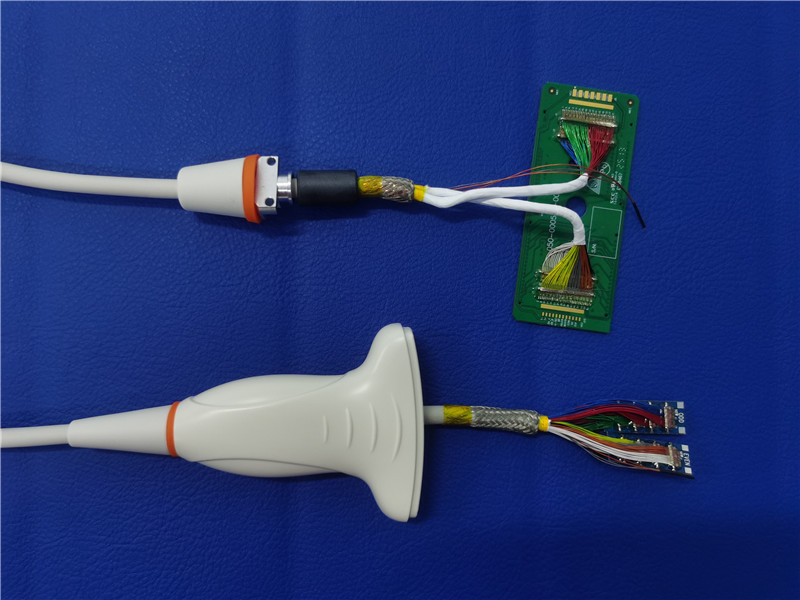

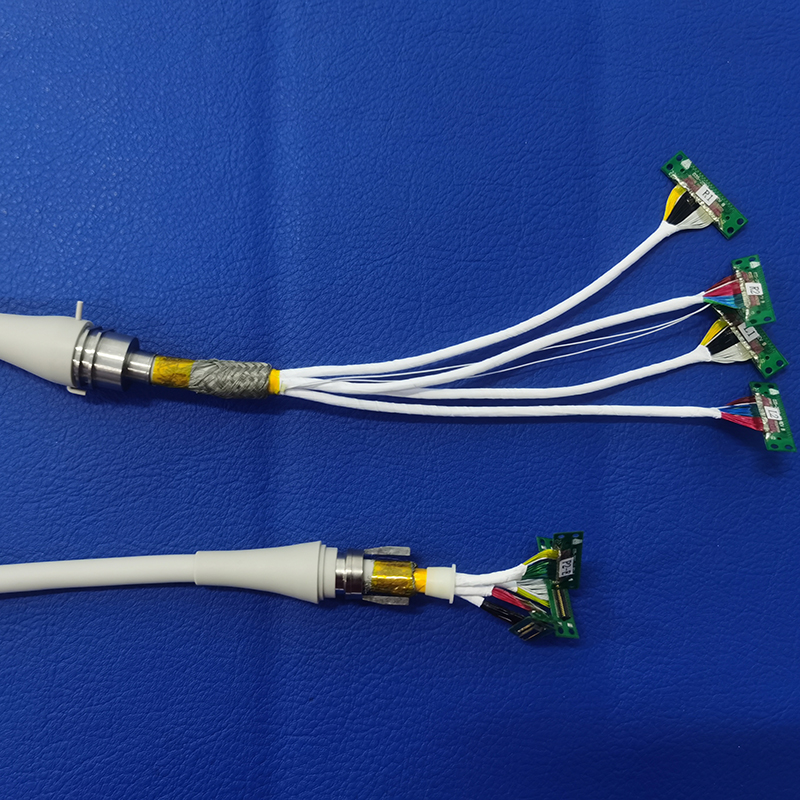

Intracavitary Ultrasonic Transducer Repair Get the latest articles from Med Device Online delivered to your inbox.